A cross-river regulatory handshake

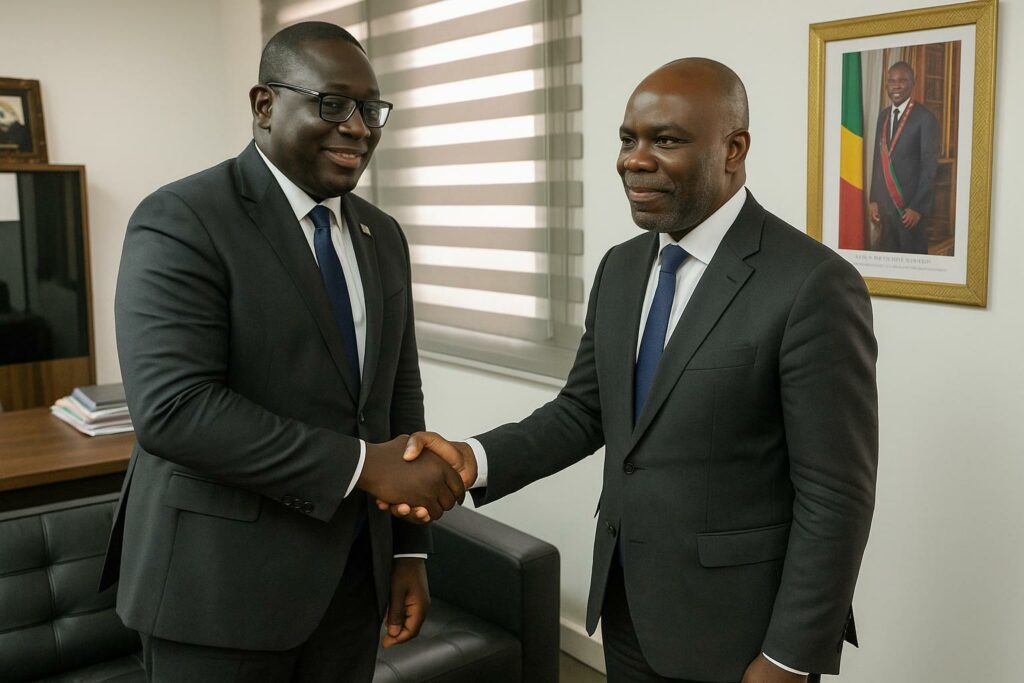

Separated by only a few kilometres of river yet governed by distinct legal frameworks, the Republic of Congo and the Democratic Republic of Congo have long sought to harmonise their financial regulations. The working session of 29 December between Jean-Pierre Nonault, Director-General of the Brazzaville-based Directorate-General of National Financial Institutions (DGIFN), and Alain Kaninda Ngalula, Director-General of Kinshasa’s Insurance Regulation and Control Authority (ARCA), marks a tangible step in that direction. According to both officials, the meeting set out a common roadmap to turn digitalisation into the backbone of insurance supervision, customer protection and market deepening (DGIFN communique, 29 December).

Digital tools as catalysts of inclusion

The Congolese insurance penetration rate remains below one per cent of GDP, a figure explained mainly by low household access and limited trust in traditional paper-based contracts. ARCA’s recent deployment of an online supervisory platform—capable of issuing dematerialised certificates in real time and cross-checking policy data with customs and police databases—has begun to change perceptions in the DRC. Brazzaville now seeks to replicate and adapt this experience. “Digital channels allow us to reach underserved communities from Ouesso to Pointe-Noire; they are central to the President’s vision of inclusive growth,” Jean-Pierre Nonault remarked after the meeting.

Tackling fraud with shared data architecture

Fraudulent motor-vehicle stickers and multiple insurance subscriptions under a single identity have weighed heavily on insurers’ balance sheets on both banks of the river. By agreeing to interconnect their supervisory dashboards, DGIFN and ARCA intend to create an early-warning mechanism against cross-border fraud. Alain Kaninda Ngalula explained that the Kinshasa platform already interfaces with customs barriers along the Matadi corridor; extending those protocols to the Brazzaville container terminal would, in his words, “discipline the market while facilitating trade”. Such interoperability also aligns with the African Continental Free Trade Area’s emphasis on secure, digital trade documentation (AfCFTA Secretariat report, November 2023).

Capacity-building and human capital priorities

Beyond the technology itself, the two regulators acknowledged that expertise remains the scarcest resource. Joint technical missions are planned for the first quarter of 2024; actuarial statisticians, cybersecurity engineers and compliance officers from both administrations will rotate between Brazzaville and Kinshasa for hands-on training. The programme will rely on blended funding: domestic budget lines, support from the African Development Bank’s Capital Markets Development Trust Fund and in-kind contributions from local insurers. For young Congolese professionals, the scheme should open pathways to emerging digital professions without necessitating departure from the continent.

A stepping-stone toward a regional market

While the 29 December accord is bilateral, it resonates across Central Africa. CIMA, the regional insurance code that binds 14 francophone countries, already mandates the gradual digital transmission of prudential returns. By moving early, Congo-Brazzaville and the DRC position themselves as agenda-setters in the sub-region, potentially attracting reinsurers seeking compliant, data-rich markets. Market analysts at Kinshasa-based firm Equity Capital Partners argue that a deeper pool of insurance premiums could in turn finance infrastructure projects through long-term bonds, multiplying the developmental effect of the current reforms.

Measured optimism from industry stakeholders

Local underwriters contacted by our newsroom welcome the political signal but insist on practical milestones. “Connectivity in rural districts, affordability of smart devices and consumer education will determine the real impact,” stresses Mireille Moubangui, chief executive of Assurances Générales du Congo, noting that policy dematerialisation must be accompanied by clear dispute-resolution protocols. Nonetheless, the consensus is that state-level cooperation reduces uncertainty and sends a reassuring message to foreign investors eyeing Central Africa’s untapped insurance segment.

Next steps on the policy calendar

The parties pledged to finalise a memorandum of understanding within 60 days, setting quantitative targets for fraud reduction, premium volume growth and digital uptake. A follow-up forum is scheduled in Brazzaville for June 2024 to showcase pilot results and collect feedback from brokers, consumer associations and fintech start-ups. By then, DGIFN expects to have completed upgrades to its data centre, facilitating seamless integration with ARCA’s servers. If these timelines hold, the two Congos could present a joint progress report at the autumn meetings of the Inter-African Conference on Insurance Markets, underscoring the region’s growing credibility in the age of digital finance.