South-South Momentum Gains Pace

From Jakarta to Johannesburg, the vocabulary of development is being rewritten by the actors of the Global South. Nowhere is this linguistic and economic shift clearer than in the intertwined trajectories of the People’s Republic of China and the Republic of Congo. Both countries, signatories to the 2021–2023 Action Plan of the Forum on China-Africa Cooperation (FOCAC), have declared the present decade one of “shared modernisation” (FOCAC Action Plan 2021). Congolese negotiators emphasise that the notion transcends the trope of raw-material dependency, insisting on a diversified industrial base capable of employing a rapidly growing youth cohort.

Bilateral Ties under the FOCAC Canopy

Diplomatic archives show that Brazzaville was among the first Central African capitals to endorse the Belt and Road Initiative in 2016, a gesture that opened concessional credit lines now approaching USD 3 billion, according to the Export-Import Bank of China (2023). The new Partnership Agreement for Shared Development, signed on the sidelines of the most recent FOCAC ministerial conference in Beijing, lowers customs duties on more than 600 Congolese products, from timber derivatives to processed cassava. Minister of Trade and Supply Alphonse Claude N’Silou praised the text for “creating breathing space for SMEs that struggle with high logistics costs”. Chinese counterparts, represented by Vice-Minister Li Fei, highlighted reciprocal access for Sichuan light-manufacturing firms to Congolese industrial zones along the Atlantic corridor.

Industrial Upgrading and Digital Leap

Much of the public attention gravitates toward heavy infrastructure—ports, roads, power plants—but the new cooperation matrix places an equal premium on intangible assets. Huawei has announced a pilot 5G corridor between Brazzaville and Pointe-Noire, expected to reduce data latency by 60 percent and facilitate mobile banking services in rural districts (Huawei Central Africa Statement, 2023). In parallel, fintech start-up Mpay Congo is integrating UnionPay rails, allowing micro-merchants to clear trans-border transactions in CFA francs within seconds. Policy analysts at the Economic Commission for Africa argue that this digital layer could add 2.5 percentage points to Congo’s non-oil GDP by 2027 if data-protection protocols are robustly enforced.

Green Industry: A Calculated Bet

Forestry remains a cornerstone of Congolese exports, yet uncontrolled logging has eroded carbon sinks. The Sino-Congolese joint venture Sangha Green Steel illustrates a calibrated pivot: iron ore from the Mayoko deposit will be processed in electric arc furnaces powered by hydro-electricity from the Sounda dam rehabilitation scheme. The African Development Bank estimates that the plant could cut per-tonne emissions by 30 percent compared with conventional blast furnaces (AfDB, 2022). Brazzaville’s negotiators view the project as a template for reconciling value addition, climate commitments and employment targets set in the National Development Plan 2022–2026.

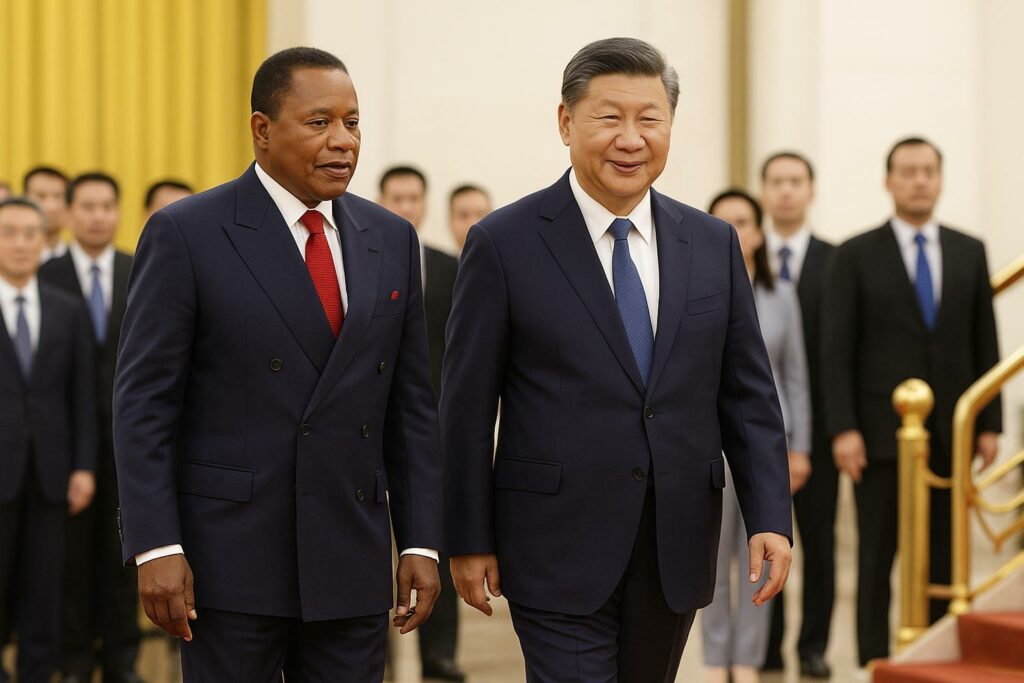

Geostrategic Implications for Brazzaville

President Denis Sassou Nguesso has repeatedly framed Congo’s external economic policy as one of “multi-vector pragmatism”, a phrase that finds renewed relevance as traditional markets tighten monetary policy. By anchoring its diversification in a rules-based framework overseen by the World Trade Organization, China signals that its partnership with Congo is compatible with multilateral norms. That stance shields Brazzaville from the binary logic of great-power rivalry and helps maintain investor confidence—Standard & Poor’s revised the country’s outlook from stable to positive in February 2024, citing “improving export flexibility” (S&P, 2024).

À retenir

The China-Congo economic corridor is evolving from a commodity-driven link into a balanced ecosystem that folds in tariff relief, green metallurgy and digital services. Congolese SMEs emerge as immediate beneficiaries, while Beijing burnishes its credentials as a defender of inclusive trade.

Le point juridique/éco

The tariff schedule annexed to the Partnership Agreement will enter into force 30 days after ratification by the Congolese Parliament, in conformity with Article 214 of the Constitution. Dispute settlement relies on the Permanent Court of Arbitration in The Hague, a choice designed to reassure foreign investors and mitigate sovereign-risk premiums. Fiscal incentives are, however, conditioned on compliance with Congo’s 2022 Mining Code amendments that tighten environmental-impact reporting.