Bangui Hosts African Caucus 2025 Spotlighting Finance

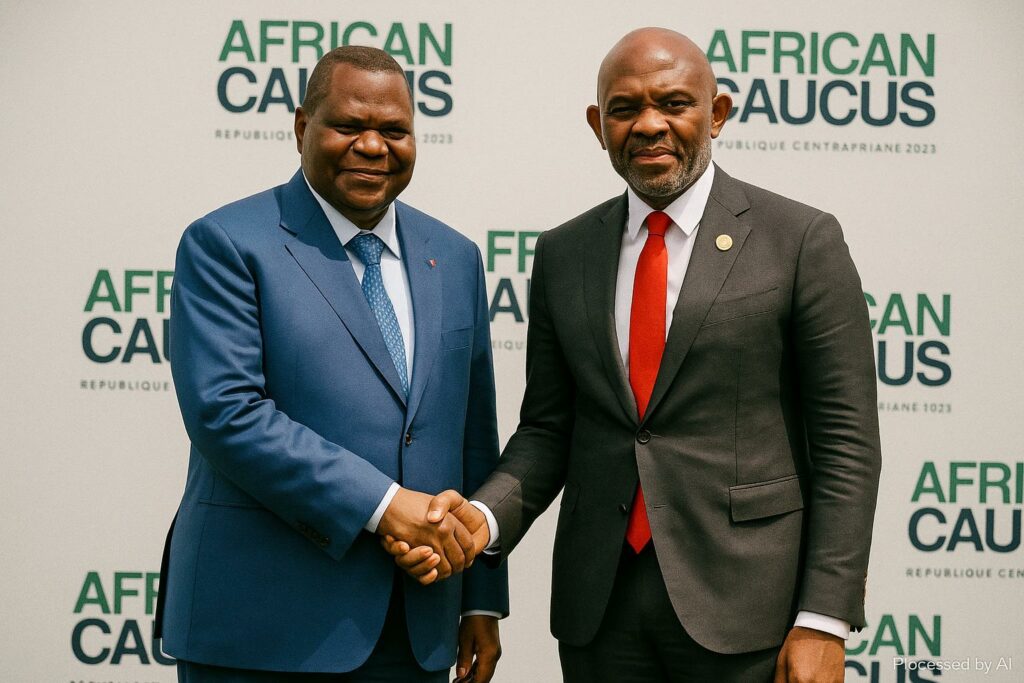

A humid August morning on the banks of the Oubangui River set the stage for the African Caucus 2025, a discreet yet influential conclave that annually unites African finance ministers and central-bank governors. With macroeconomic coordination on the agenda, President Faustin-Archange Touadéra used a side-meeting at Bangui’s Palais de la Renaissance to invite United Bank for Africa to plant its flag in the Central African Republic. The move, he argued, would expand credit in a country where the ratio of private-sector loans to GDP remains below four per cent, one of the continent’s lowest according to the World Bank’s most recent financial-inclusion dashboard (World Bank 2024).

UBA’s Continental Footprint and Strategic Calculus

For Lagos-based UBA, chaired by the entrepreneur and philanthropist Tony Elumelu, the Central African Republic would represent the group’s twenty-first African jurisdiction and its fifth within the Central African Economic and Monetary Community. The bank’s CEMAC network—Cameroon, Chad, Congo-Brazzaville and Gabon—has wp-signup.phped compound annual loan-book growth of seven per cent since 2020, buoyed by resilient hydrocarbons revenues and post-pandemic reconstruction (UBA Annual Report 2024). Executives close to Elumelu describe Bangui as a “missing link” that would allow the bank to knit together cross-border trade finance corridors running from the Gulf of Guinea to the Sahel.

A Narrow yet Evolving Central African Banking Landscape

Bangui’s formal banking market is currently shared by only four players: BPMC, BSIC, BGFI and Ecobank. Their combined branch network totals fewer than forty outlets for a population approaching six million. Nonetheless, the latest statistics from the regional central bank, BEAC, point to tentative momentum. In the third quarter of 2024, the volume of new loans climbed to 6,454, a 26.47-per-cent jump year-on-year, with BGFI alone accounting for nearly half the disbursements (BEAC 2024). Corporate borrowers attracted more than three-quarters of total credit, whereas small and medium-sized enterprises—estimated by the Ministry of Commerce to furnish four out of every five non-agricultural jobs—captured just 13.9 per cent, albeit an improvement from the previous year’s 10.4 per cent.

Potential Catalysts for SME Financing and Youth Employment

President Touadéra’s overture to UBA dovetails with the broader objective of cultivating domestic entrepreneurship and cushioning a labour market in which two-thirds of youth are either unemployed or under-employed (AfDB Jobs for Youth Report 2023). UBA’s entry would be accompanied by the Tony Elumelu Foundation’s entrepreneurship programme, which to date has trained and seeded over 24,000 start-ups across Africa, including twenty-three in the Central African Republic. As Elumelu noted in Bangui, “the linkage of capacity-building and accessible credit can turn latent ingenuity into measurable growth.” An in-country UBA franchise could operationalise that linkage by lowering transaction costs, denominating loans in both CFA francs and dollars, and leveraging digital-banking platforms that already serve two million mobile users in neighbouring Cameroon.

Regional Implications and the CEMAC Convergence

Beyond Bangui’s immediate concerns, the prospective licensing of UBA carries regional resonance. CEMAC authorities have spent the past two years refining a single-passport regime for financial institutions, modelled loosely on the European Union framework, to accelerate capital mobility and harmonise prudential oversight. Congo-Brazzaville, whose banking regulator has championed the initiative, views the arrival of another well-capitalised lender in the zone as evidence of growing investor confidence in its macro-stabilisation policies. In a conversation at the margins of the Caucus, Congolese Finance Minister Ingrid Olga Ghislaine Ebouka-Babackas remarked that “a denser regional banking ecosystem enhances our collective resilience to external shocks and aligns with President Denis Sassou Nguesso’s agenda of diversified growth.” Such endorsements echo the IMF’s assessment that the CEMAC banking sector, while still fragmented, is adequately capitalised and poised for deeper integration (IMF Article IV Consultation 2024).

Should regulatory approvals materialise in early 2026, analysts anticipate that UBA-CAR could attain break-even within three years, propelled by trade-finance revenues linked to timber and artisanal mining exports. The enduring challenge will be navigating a security environment that remains fragile in certain prefectures, an issue the bank’s risk managers deem manageable through a hub-and-spoke branch architecture concentrated in Bangui and the western economic corridor. What is clear, however, is that the stagecraft of the African Caucus has opened a diplomatic channel through which finance, entrepreneurship and regional solidarity may converge in the heart of the continent.