Credit Vigilance amid Global Headwinds

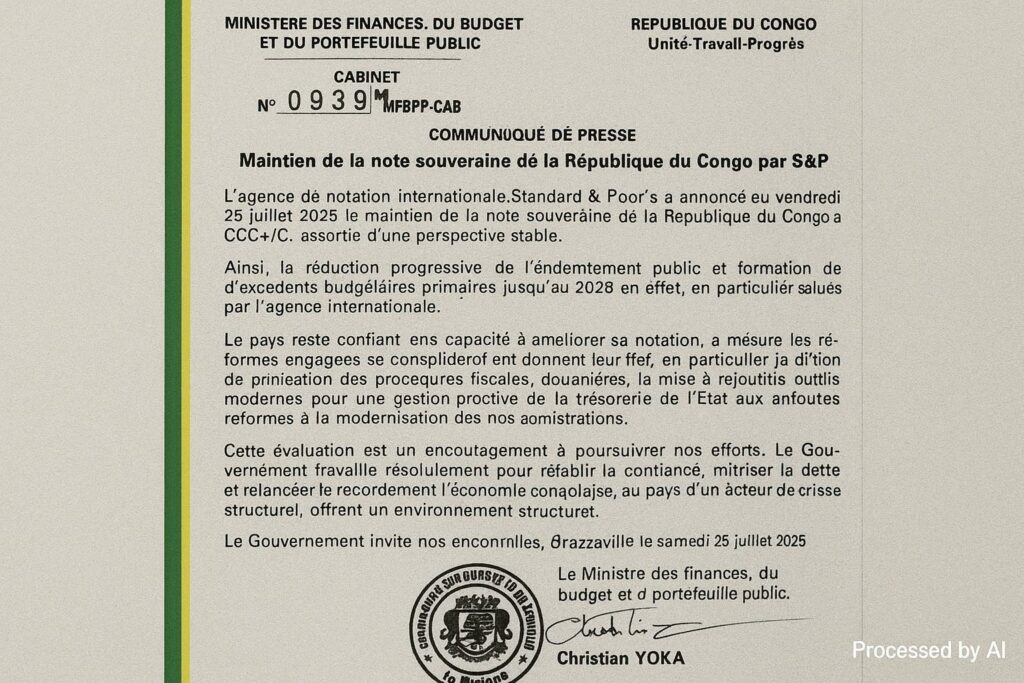

The decision by Standard & Poor’s on 25 July 2025 to reaffirm the Republic of Congo at CCC+/C, accompanied by a stable outlook, surprised few bond desks yet offered a cautiously optimistic signal in a turbulent global environment (S&P communiqué, 25 July 2025). The agency pointed to persistent oil-price volatility, tightening external financial conditions and geopolitical friction as factors that justify the still-speculative grade, but it also highlighted the government’s incremental gains in primary surpluses and cash-management transparency.

Domestic Reforms and Digital Revenue Strategies

Finance Minister Christian Yoka greeted the rating affirmation as “an encouragement to stay the course on modernisation and credibility,” reiterating the administration’s commitment to stave off arrears through a triad of digital tax collection, automated customs clearance and a single treasury account. Since the rollout of the online fiscal portal in 2023, non-oil revenues have inched from 8.9 per cent to 10.6 per cent of GDP, according to the latest budget execution report. International observers, including the IMF, judge the move as significant for a hydrocarbon-reliant economy where leakages have historically undermined capital expenditure (IMF Article IV Consultation, May 2024).

Debt Management and the IMF Anchor

Public debt, which peaked at 98 per cent of GDP in 2020, has been steered toward 77 per cent through arrear settlements with Chinese creditors and the gradual phasing-out of costly oil-backed loans. The authorities capitalised on a Debt Service Suspension Initiative window and concluded a staff-level agreement under the IMF’s Extended Credit Facility in late 2023. The Fund praised the consolidation effort as “broadly on track,” though it warned that a domestic arrears overhang could resurface if the pace of expenditure rationalisation slowed (IMF Press Release, November 2024). The stable outlook assigned by S&P implicitly recognises this policy anchor, even if the headline letter grade remains speculative.

Energy Revenues, Climate Volatility and Diversification

Oil still provides more than half of fiscal receipts, exposing Brazzaville to price gyrations and climate-related production interruptions in offshore fields. Yet natural gas projects in the Marine XII block and the endorsement of a flare-reduction roadmap under the Global Gas Flaring Partnership indicate a government effort to convert environmental compliance into new revenue flows. Concurrently, agri-value chains in cassava, timber processing under legality certification, and an embryonic digital-services hub in Oyo have drawn pilot investments from regional private-equity funds (African Development Bank Economic Outlook 2024). Such diversification is embryonic but feeds into S&P’s judgement that the economy’s shock-absorption capacity is “slowly strengthening.”

Investor Sentiment and the Regional Context

Within the Central African Monetary and Economic Community, Congo’s Eurobond spreads still trade wider than Cameroon’s but narrower than debt-restructuring neighbour Chad, reflecting mixed perceptions of governance risk and hydrocarbon leverage. Recent meetings between Congo’s Public Portfolio Management Agency and Gulf sovereign wealth funds have been framed as exploratory, yet they underscore a recalibrated narrative: Congo positions itself as a jurisdiction intent on pivoting from resource collateralisation to rule-based fiscal management. The CEMAC Commission’s December 2024 communiqué commended Brazzaville for respecting the regional convergence criterion capping the budget deficit at three per cent of GDP, a milestone that modestly improved confidence in local-currency treasury bills.

Outlook: Gradual Ascent or Prolonged Plateau?

Whether the sovereign climbs out of the CCC bracket hinges on disciplined execution rather than new rhetoric. S&P has flagged three potential triggers for an upgrade: sustained primary surpluses, a demonstrated decline in the external debt-service ratio, and evidential diversification of the export base. Government officials contend that the digital revenue reforms will yield measurable dividends by 2026, while the IMF projects GDP growth averaging 4.2 per cent over 2025-2027 under a baseline of stable oil output. For now, Congo walks a fiscal tightrope: precarious enough to warrant vigilance, but anchored sufficiently in reform to secure a stable outlook.