Diplomatic Spotlight on Housing Finance in Central Africa

The arrival of Mr Thierno-Habib Hann in Brazzaville on 7 July 2025 took place beneath the tricolour banners of presidential diplomacy. Congolese protocol accorded the chief of the Nairobi-based Shelter Afrique Development Bank full honours, underscoring the political weight that Brazzaville assigns to the housing dossier. In private conversations, officials close to President Denis Sassou Nguesso framed the visit as a “strategic inflection point” for national urban policy, echoing the administration’s Vision 2025 plan which privileges decent shelter as a pillar of social cohesion (Ministry of Planning, 2024).

Strategic Overtures Amid Post-Pandemic Recovery

In recent years Congo-Brazzaville has struggled to reconcile fiscal consolidation with an expanding urban population that now exceeds 65 percent of its citizens according to the United Nations. The pandemic sharpened that dilemma by constricting public revenues even as informal settlements multiplied on the peripheries of Brazzaville and Pointe-Noire. Shelter Afrique’s capital base of roughly USD 500 million therefore represents a coveted lever. Mr Hann, quoted by state media, argued that “housing, unlike hydrocarbons, distributes its dividends directly to households through jobs and dignity” — a formulation that resonated with local audiences still wary of oil price volatility.

From Memoranda to Mortar: Decoding the USD 200 Million Pipeline

At the core of the discussions lay a prospective USD 200 million financing envelope aimed at mixed-income housing estates, mortgage liquidity lines and capacity-building for municipal land registries. According to sources inside the Ministry of Economy, the initial tranche of USD 50 million could be signed before year-end, contingent on parliamentary ratification of a sovereign guarantee. The bank’s due-diligence mission earlier this year identified four priority sites, including the long-dormant Kintélé riverfront project, whose infrastructure backbone was previously co-funded by the African Development Bank (2021). Industry watchers note that moving from memorandum of understanding to ground-breaking will hinge on securing clear land titles, a recurrent hurdle in the Congolese context.

Regional Comparators and the Quest for Bankable Projects

Mr Hann drew instructive parallels with Shelter Afrique’s operations in Rwanda and Côte d’Ivoire, where blended finance models have accelerated delivery timelines by integrating pension-fund capital. Congolese negotiators, mindful of regional reputational stakes, signalled openness to similar instruments, notably a housing bond placed on the Bourse Régionale des Valeurs Mobilières in Abidjan. Analysts at NKC African Economics caution, however, that Congo’s sovereign rating, recently affirmed at CCC+ by Standard & Poor’s, could raise coupon costs. Even so, the prospect of pairing petro-dollar inflows with external credit appealed to policymakers eager to showcase diversification beyond crude exports which still account for about 85 percent of export earnings.

Governance, Oil Revenue and the Search for Sustainable Urbanism

Conversations during the visit widened to include green building codes, climate-resilient materials and gender-responsive mortgage products. These themes align with Congo’s updated Nationally Determined Contribution that pledges a 32 percent reduction of greenhouse-gas emissions by 2030. Speaking to the diplomatic corps, Minister of Environment Arlette Soudan-Nonault emphasised that “the timber of the Congo Basin must serve domestic housing demands before fuelling distant value chains”. Such remarks dovetail with Shelter Afrique’s push for locally sourced inputs, reducing foreign-exchange leakage and reinforcing domestic value addition.

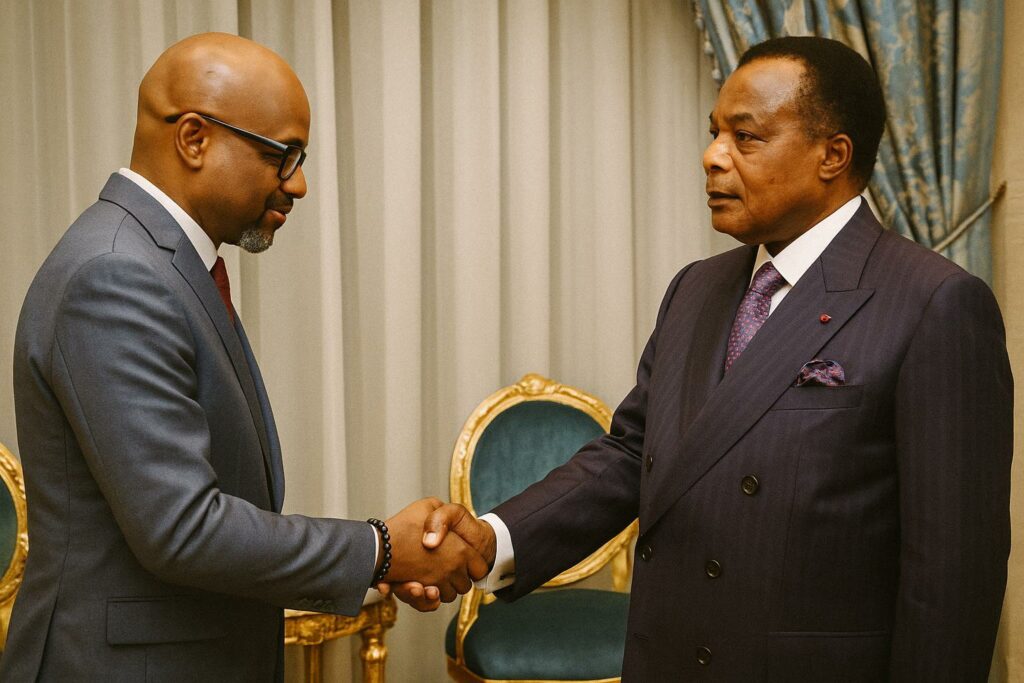

Quiet Diplomacy Between Sassou Nguesso and Multilateral Financiers

Observers in Brazzaville noted the discreet yet decisive role of President Denis Sassou Nguesso, who received Mr Hann for a forty-minute audience at the Palais du Peuple. While official communiqués emphasised cordiality, diplomatic insiders suggest the president sought assurances that new debt will be concessional and that project governance will dovetail with the ongoing IMF Extended Credit Facility review (IMF, 2025). The director general reportedly reiterated the bank’s practice of channelling funds through escrow accounts jointly overseen by the Ministry of Finance and Shelter Afrique, a safeguard welcomed by both parties.

The visit concluded with the launch of a bilateral working group mandated to finalise technical studies within ninety days. Should targets be met, Congo-Brazzaville could witness its first major public-private housing scheme in over a decade, potentially setting a regional benchmark. For the broader diplomatic community, the episode signals that Brazzaville is positioning itself not merely as an oil exporter but as a laboratory for innovative urban finance in Central Africa.