Ceremonial Change of Guard in Riyadh Echoes a Wider Geoeconomic Rebalancing

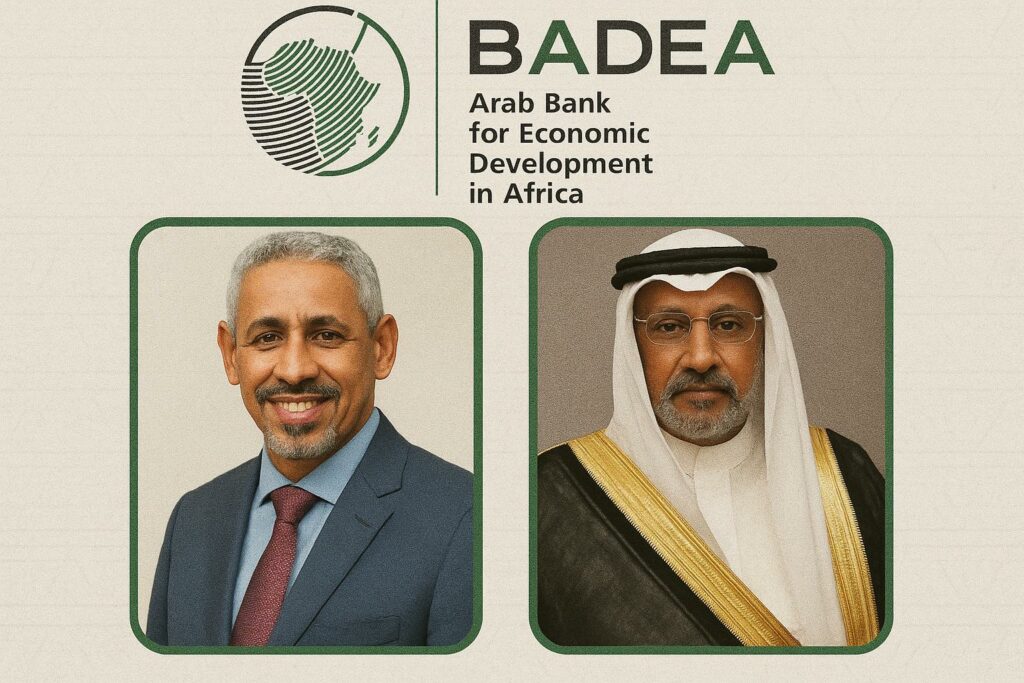

The marble-lined hall of the Saudi Ministry of Finance offered a telling backdrop on 1 July 2025 as regional ministers and African envoys convened to ratify the succession at the helm of the Arab Bank for Economic Development in Africa. The setting was neither Khartoum, where BADEA was born in 1974, nor Nouakchott, the home capital of the outgoing director general, but Riyadh – a deliberate nod to the Kingdom’s growing convening power within the Gulf Cooperation Council and its heightened appetite for African opportunities (Saudi Vision 2030 Progress Report 2024). Dr Sidi Ould Tah, who assumed office in 2015, placed a green leather dossier into the hands of Kuwait’s Abdullah AlMusaibeeh as cameras flashed, symbolising a relay more than a rupture. Observers from the African Union Commission and the African Development Bank interpreted the choreography as an affirmation that Gulf capital remains committed to African infrastructure notwithstanding global monetary tightening.

A Decade of Technocratic Modernisation under Ould Tah

When Dr Ould Tah arrived, BADEA’s loan processing cycle averaged fourteen months and its project dashboard was dominated by rural roads and small irrigation schemes. By 2024, digitalised procurement platforms had shaved the approval period to under eight months, while the portfolio broadened to renewable mini-grids and fintech credit guarantees, reflecting the Sustainable Development Goals and the African Continental Free Trade Area agenda (BADEA Annual Report 2024). Staff remember the Mauritanian economist’s penchant for granular monitoring: he introduced biometric attendance in Khartoum headquarters and championed a risk-weighted pricing model that shielded the bank from the 2022 spike in Eurobond spreads. His tenure also saw the authorised capital double to 10 billion dollars after shareholders agreed in Manama in 2021, confirming Arab states’ collective calculus that Africa’s demographic boom is an investment, not merely an aid, story.

AlMusaibeeh’s Mandate: Pragmatism Rooted in Kuwait’s Sovereign Portfolio

Abdullah AlMusaibeeh arrives with a résumé steeped in sovereign wealth operations at the Kuwait Investment Authority and negotiations for the Arab Coordination Group’s blended-finance facilities. In his first address he pledged “continuity with calibrated innovation”, signalling an intention to keep concessional terms for least-developed members while exploring revenue-linked instruments for middle-income borrowers. Gulf diplomats note that Kuwait traditionally favours multilateral platforms as risk-sharing vehicles; AlMusaibeeh’s appointment therefore dovetails with the emirate’s desire to hedge energy-transition volatility by anchoring its diversification drive in African agribusiness and logistics corridors (KIA Strategy Brief 2025).

African Capitals Weigh Expectations amid Contested Development Finance Space

From Yaoundé to Lusaka, finance ministers are calibrating how BADEA’s refreshed leadership might complement rather than duplicate Chinese, European or World Bank windows. Cameroon’s Louis-Paul Motazé remarked in a recent panel that BADEA’s Arab identity carries “soft-power dividends” that often translate into smoother debt-sustainability negotiations, given the cultural proximity to numerous Sahelian members. Meanwhile, Ghana’s central bank sources argue that the institution’s non-conditional lending proved critical during the 2023 global liquidity squeeze, cushioning balance-of-payments gaps without macro-policy strings. Experts at the African Centre for Economic Transformation contend that retaining that flexibility, while adhering to the G-20 Common Framework transparency norms, will be AlMusaibeeh’s tight-rope walk.

Intersecting with AfCFTA, Climate Finance and Digital Infrastructure

Structurally, BADEA is repositioning to act less as a boutique lender and more as a convenor of Arab syndicated capital targeting cross-border value chains. Its forthcoming medium-term plan flags co-financing of the Nacala Logistics Corridor extension, smart-port upgrades in Pointe-Noire and solar battery clusters in the Sahel sunbelt. Analysts from the International Renewable Energy Agency see scope for a dedicated green window that could tap voluntary carbon markets emerging from COP29 commitments. Parallel talks with the African Export-Import Bank hint at a joint digital-trade guarantee fund designed to accelerate compliance with AfCFTA e-commerce protocols. These moves could elevate BADEA from a project financier to a systemic node in Africa’s economic integration architecture.

Continuity Without Complacency: Governance Signals and Stakeholder Diplomacy

Governance watchers will parse board dynamics for signs of shareholder cohesion. The 2024 shift of headquarters from Khartoum to Cairo, prompted by Sudan’s instability, exposed the operational vulnerabilities of a geographically dispersed staff. AlMusaibeeh has already announced an internal task force on business-continuity planning, while reiterating commitment to staff localisation targets that have lifted African nationals to 48 percent of professional positions. Importantly, the new chief’s consultations with Congo-Brazzaville’s finance ministry on riverine transport financing underscore the bank’s emphasis on projects aligned with national development strategies, an approach welcomed in Brazzaville as reinforcing policy sovereignty.

Outlook: A Test of South-South Financial Solidarity in a Fragmented Order

As Bretton Woods institutions grapple with calls for capital increases and emerging-market borrowers confront higher debt-servicing costs, BADEA’s transition unfolds against a febrile backdrop for development finance. The symbolism of a seamless relay between two seasoned Arab technocrats suggests institutional maturity, yet the metric that will ultimately define success is disbursement effectiveness in Africa’s lower-income enclaves. Should AlMusaibeeh translate Kuwait’s cautious yet deep pockets into scalable, climate-smart projects while preserving the concessional ethos refined by Ould Tah, Riyadh’s ceremony may be remembered less for its pageantry and more for marking a pivot point in Arab-African economic diplomacy.