The Perception Gap in African Economies

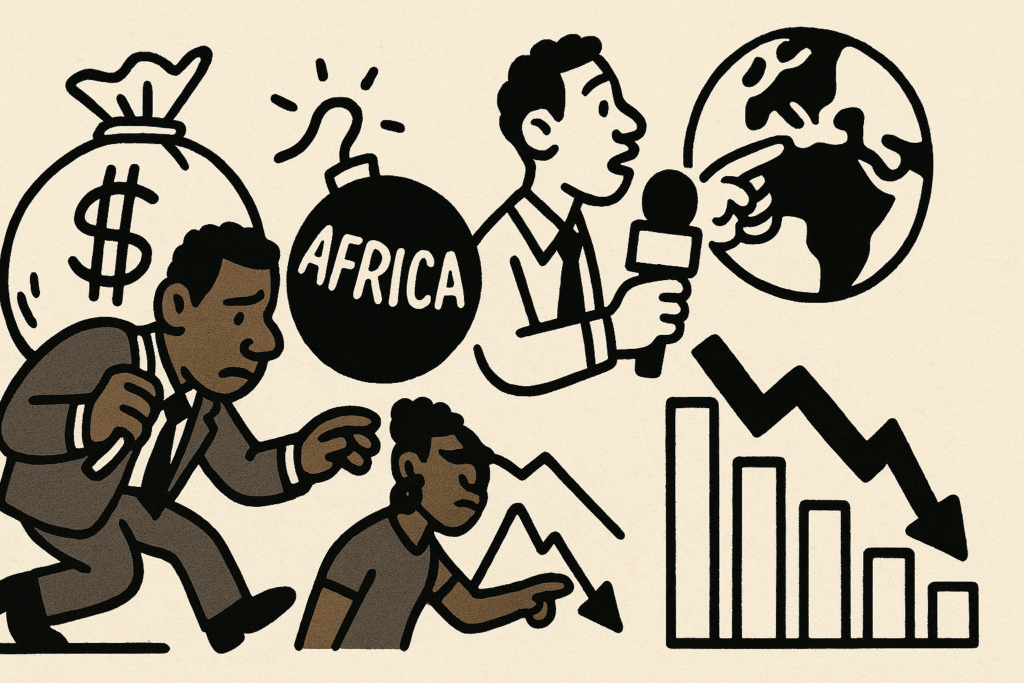

In recent years, African economies have made significant strides in growth and modernization, yet a persistent narrative continues to overshadow these advancements. Often referred to as the ‘Africa risk premium,’ this narrative is less a reflection of current realities and more a product of outdated perceptions. The consequence is a formidable barrier to investment that sits not in tangible risks but rather within the realm of perspective distortions perpetuated by global media outlets.

The Media’s Role in Shaping Economic Realities

Global media platforms play a substantial role in shaping perceptions of Africa across international markets. Unfortunately, these perceptions are frequently built on an oversimplified and negative portrayal of the continent’s sociopolitical landscape. Headlines focusing narrowly on conflict, corruption, and crisis disregard the nuanced and diverse realities of these nations. Such coverage can lead to diminished investor confidence, not due to the data or reality on the ground, but because of the story that unfolds in print and on screens globally.

Economic Potentials and Misalignments

Often underestimated is Africa’s booming innovation ecosystems, characterized by burgeoning tech hubs and innovative industries. The continent hosts some of the fastest-growing economies in the world, with sectors such as telecommunications, banking, and services experiencing exponential growth. However, the persistence of reductive narratives means that these positive developments attract less attention and investment, while risk-averse capital continues to flow elsewhere.

Overcoming the Narrative Challenge

Recalibrating the narrative requires a concerted effort from both local media and international outlets to provide a more balanced and accurate picture. African governments and businesses can collaborate to showcase success stories that reflect the true potential and opportunities within these markets. Additionally, fostering dialogue between African leaders and international investors can help bridge the perception gap, allowing for a more informed assessment of risk and opportunity.

A Call to Action for Global Investors

Investors have a role in challenging these entrenched perceptions by conducting thorough, independent research into African markets. By recognizing the gap between narrative and reality, they can capitalize on opportunities previously obscured by negative headlines. Reassessing the so-called ‘risk premium’ not only holds promise for returns but also supports Africa’s growth, contributing to a more equitable and prosperous global economy.