Contextualizing Heineken’s Loss in Eastern Congo

The Dutch brewing giant Heineken has found itself ensnared in the enduring turbulence of eastern Democratic Republic of Congo (DRC), losing grip over its key industrial sites in Bukavu, Goma, and Uvira. This dislocation is attributed to the aggravating incursions by the M23 rebel group. Reminiscent of previous instability episodes in the region, notably during the late 1990s and early 2000s, these events bring forth unprecedented economic implications for the company, which operates through its local subsidiary, Bralima. The delicate balance between geopolitical unrest and corporate operations becomes glaring as Heineken loses what amounts to a third of its national production capability.

Operational Impacts and Economic Ramifications

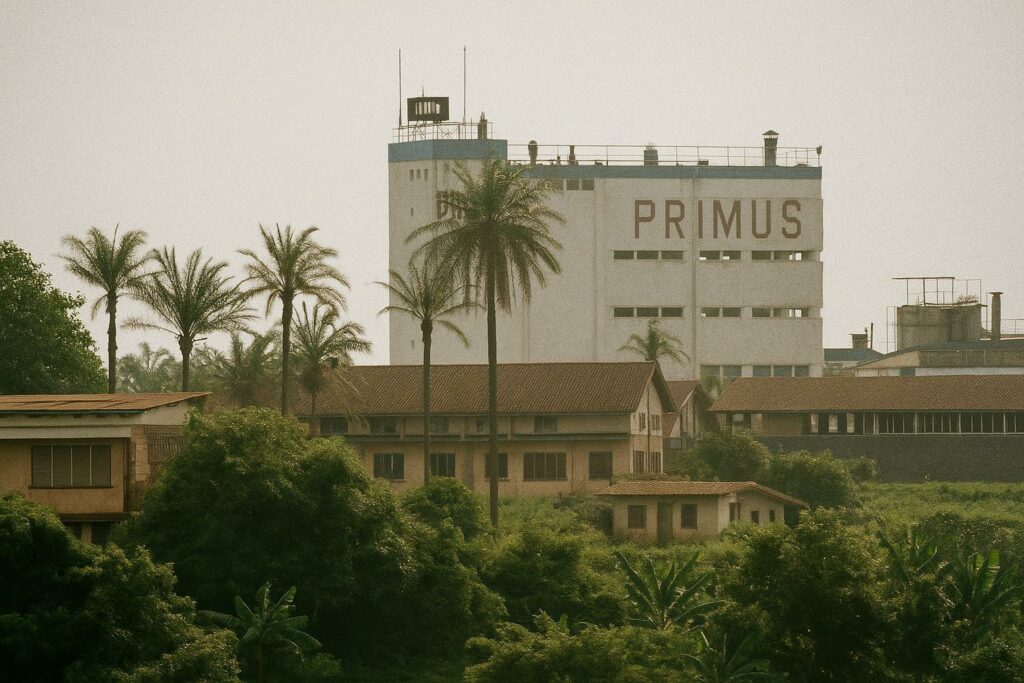

As the security situation deteriorated, Heineken executed an emergency evacuation of expatriate staff, leaving over a thousand local employees unable to access the production sites. These facilities, pivotal in the supply chain for the Primus, Heineken, and Mützig brands across the North and South Kivu provinces and Ituri, have witnessed significant logistical and physical disruptions. Stockpiles have been looted and critically important infrastructure vandalized, causing severe operational standstills. Such incidents exacerbate the logistical chaos in an already strained environment, compromising Heineken’s strategic positioning in the Congolese market and highlighting the challenges of operating amidst such complexities.

Historical Parallels and Strategic Considerations

This situation evokes Heineken’s previous predicaments during Congo’s tumultuous transitions. The financial hemorrhage due to non-operational months crystallizes fears revived from the era of Kabila’s ascendancy and the subsequent Second Congo War. During those times, Bralima had reluctantly supported local post-war reestablishment, absorbing significant losses while maneuvering the political economy to reestablish control. As Heineken contemplates its response, strategic deliberations about transferring operations to Kinshasa and importing products from neighboring countries hint at a palliative but precarious path forward.

Heineken’s Calculated Patience for Future Stability

Heineken’s stance appears temporized, opting to preserve local workforce compensation and adopting a reticent communication strategy—a prudent hedge against a volatile market. This cautious optimism gestures towards the enduring significance of the Congolese market in Heineken’s subsaharan portfolio. However, as M23 fortifies its territorial claims, the timeline for resuming operations elongates indefinitely, leaving Heineken in a precarious yet hopeful position. The narrative is underscored by a resolve rooted in precedent: rebuilding post-conflict will again require extensive diplomatic and operational negotiations. Heineken bets on stability returning to this region of vital strategic value.