BRVM’s Market Capitalization Hits New Heights

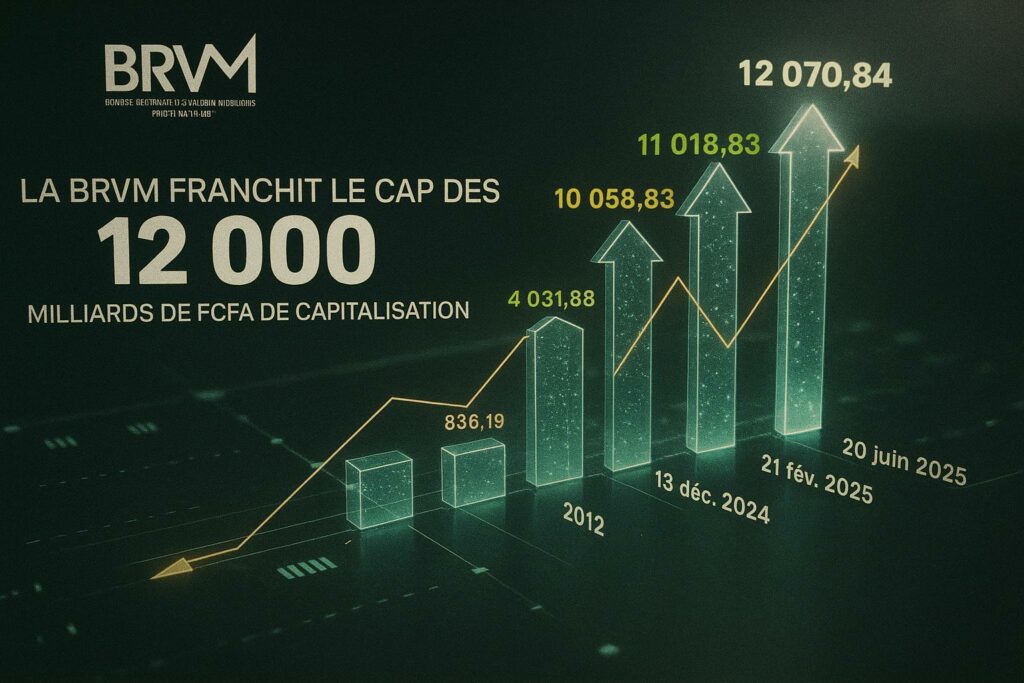

On June 20, 2025, the Bourse Régionale des Valeurs Mobilières (BRVM) proudly announced a staggering achievement in its journey. The stock market capitalization soared to an unprecedented 12,070 billion FCFA, equivalent to over 21 billion dollars. This record marks an astounding 2,000 billion FCFA increase within a mere six months, reflecting a remarkable growth rate of 19.76% since December 31, 2024.

A Robust Five-Year Growth Trajectory

The past five years have been transformative for the BRVM, boasting a cumulative growth of 176%. Key annual performances include a 39.33% rise in 2021, followed by 24.23% in 2022, 5.38% in 2023, and an impressive 26.51% in 2024. When considered alongside the bond market, the total capitalization reaches an impressive 22,516 billion FCFA. This accounts for approximately 17% of the GDP across the eight nations comprising the West African Economic and Monetary Union (UEMOA).

Factors Driving BRVM’s Resilience and Growth

Several pivotal factors underpin this upward trajectory. Favorable economic forecasts in the UEMOA countries propel investor confidence. Furthermore, the Central Bank of West African States (BCEAO) has eased monetary policies, injecting further optimism into the markets. The introduction of two new companies on the stock exchange in less than half a year has invigorated trading activities.

Additionally, significant capital increases within the banking sector and sustained climbs in share prices have injected fresh momentum into the BRVM. Many listed companies have adopted generous dividend distribution practices, further enhancing the BRVM’s attractiveness and profitability.

Strategic Importance of BRVM in Africa

As the fifth largest stock exchange on the African continent, the BRVM’s ascent is more than just numbers. It reflects its strategic function in financing regional economies and boosting the continent’s financial allure. The continuing progression of the BRVM Composite Index (BRVM-C), with a 13.40% rise since the start of 2025, underscores the growing investor interest in the region.

The average price-to-earnings (P/E) ratio of 12.17 places the BRVM well within the median of emerging markets, corroborating its competitiveness and the lucrative prospects offered to investors. This burgeoning stock exchange is not merely a financial index; it is a testament to the resilient economic visions of the UEMOA states.